The Best Gold IRA Companies in 2022

Written by: Andrew Grenier

Though many individuals have traditional retirement accounts, more and more savvy investors are turning towards alternative investments because of the current market risks.

Precious metals are an excellent hedge against inflation, a declining stock market, recessions, and currency devaluations. Below we detail the most qualified companies to open a precious metals IRA with. These companies have the best investor feedback, pricing, business ratings, long term customers, and trustworthy systems.

Disclosure: We may receive compensation if you purchase through the links on this website. However, this does not affect how much you pay or the integrity of our review. We simply choose the best option for retirees.

Rankings | Company | Featured | Rating | Contact |

|---|---|---|---|---|

#1 |  | Best Pricing, Customer Service | 4.9/5 Rating | |

#2 | Best Customer Feedback | 4.8/5 Rating | ||

#3 |  | Best Buyback Program | 4.7/5 Rating | |

#4 |  | Lowest Minimum | 4.5/5 Rating | |

#5 | Best Education | 4.4/5 Rating |

#1 Best Pricing

4.9/5 Rating

#2 Best Client Feedback

4.8/5 Rating

#3 Best Buyback Program

4.7/5 Rating

#4 Lowest Minimum

4.5/5 Rating

#5 Best Education Options

4.3/5 Rating

#1: Goldco

4.9/5 Rating

*Most Trustworthy

*Best service

*Best Pricing

Goldco was founded by Trevor Gerszt in Los Angeles, and is devoted to helping investors build wealth over time. It has 65 employees and an executive team that includes 11 key decision makers. The executive team focuses on providing customers with multiple metal coins and other products that can be used in an individual retirement account. Several consumer review sites have given the company a positive rating, and most customers are pleased with the service and the value of Goldco products.

The company is also known for its excellent customer service. Its account executives are available to answer any questions you may have, and they are dedicated to ensuring your precious metals are delivered on time.

The Better Business Bureau and the Business Consumer Alliance rate Goldco with an A+ rating. The Better Business Bureau's website also has 300+ reviews with an average rating of 4.8 stars.

Goldco Fees

The required minimum purchase at Goldco to start a gold IRA is $25,000. Goldco’s preferred Custodian charges a flat annual account service fee which includes a one-time IRA account set-up fee of $50. as well as a $30 wire fee. Annual maintenance is $100, and storage is $150 for segregated storage or $100 for non-segregated storage.

Fees for gold storage and custodianship can vary depending on the company you select to handle these services (required by the IRS, as all IRA assets must be managed by a custodian). Depending on the Custodian, storage fees can range from $10 to $60 per month, or as a percentage of assets, from 0.35% to 1% annually. Goldco does not charge any storage fees for cash transactions over $25,000.

American Hartford, Augusta Precious Metals, Regal and Birch GG are other great options. This company is located in California and provides gold IRA services to investors throughout the US. They offer a variety of services, including expert advice, informational materials, and personalized portfolio plans. Their aim is to provide the best possible service and support, which is why they have hundreds of satisfied customers. They have an A+ rating from the Better Business Bureau and have an impressive five-star rating on Trustpilot.

#2 Augusta Precious Metals

4.8/5 Rating

*Best customer feedback

*Unique educational opportunities

*No complaints since inception

Augusta Precious Metals has been around since 2012 and offers a variety of gold and silver investment options. The company is registered with the Delaware Depository to ensure your assets are kept secure. You can choose to invest in gold coins, bars, or other physical forms of the precious metal.

Augusta Precious Metals is one of the best gold IRA companies on the market today. Its services are transparent and easy to use. Its staff guides you through the creation of a new account. It has an impeccable reputation as a trustworthy gold investment company, and has received good feedback from a range of organizations, including the Better Business Bureau.

Augusta Precious Metals focuses on building relationships with its customers. The company's aim is to generate a large number of satisfied customers, who will then refer them to family and friends.

Augusta Precious Metals is one of the best gold IRA companies on the market, and their unique approach to customer education makes it a superior choice. Customers are able to setup accounts online or by phone, and account representatives will take the time to understand your financial goals. They also have transparent pricing, which makes Augusta one of the best gold IRA companies on a number of levels.

Buying gold with a gold IRA is a good hedge for your portfolio. However, you must be sure to keep your risk level low. You should also read reviews on gold IRA companies before deciding which company to use. This will allow you to make informed decisions and avoid making a costly mistake.

#3 American Hartford Gold

4.7/5 Rating

*Best buyback program

*Low minimum investment

*Best brand recognition

The American Hartford Gold IRA is an excellent investment for those who are looking to diversify their portfolio and invest in precious metals. American Hartford Gold is a BBB-accredited company that offers competitive pricing and exceptional service. The company is also one of the fastest-growing private companies in the country. They are known for their swift processing and top-notch customer support. The company strives to ensure customer satisfaction and safety, regardless of the state of the economy.

The risks associated with gold and precious metals are high, and you should be aware of the risks involved. Be wary of any investment that promises low risk, and always make sure to understand the fees and terms associated with the transaction. If you're not sure where to start, American Hartford Gold can help you make a good decision by offering a free 25-page information guide.

American Hartford Gold offers a variety of benefits to its customers, including a price match guarantee. They'll match any competitor's prices and offer educational resources and industry experts. Their products and services are also backed by outstanding customer service ratings on TrustLink and Trustpilot. If you're interested in purchasing gold or silver, American Hartford Gold may be the right investment option for you.

The American Hartford Gold IRA allows investors to invest in precious metals without paying taxes. These metals are usually sold in coins or bars, and they can be stored and traded in a secure location. Investing in gold IRAs is a great way to diversify your portfolio and protect it from market volatility. The firm's experienced staff of gold and silver specialists strive to provide its customers with quality service and support.

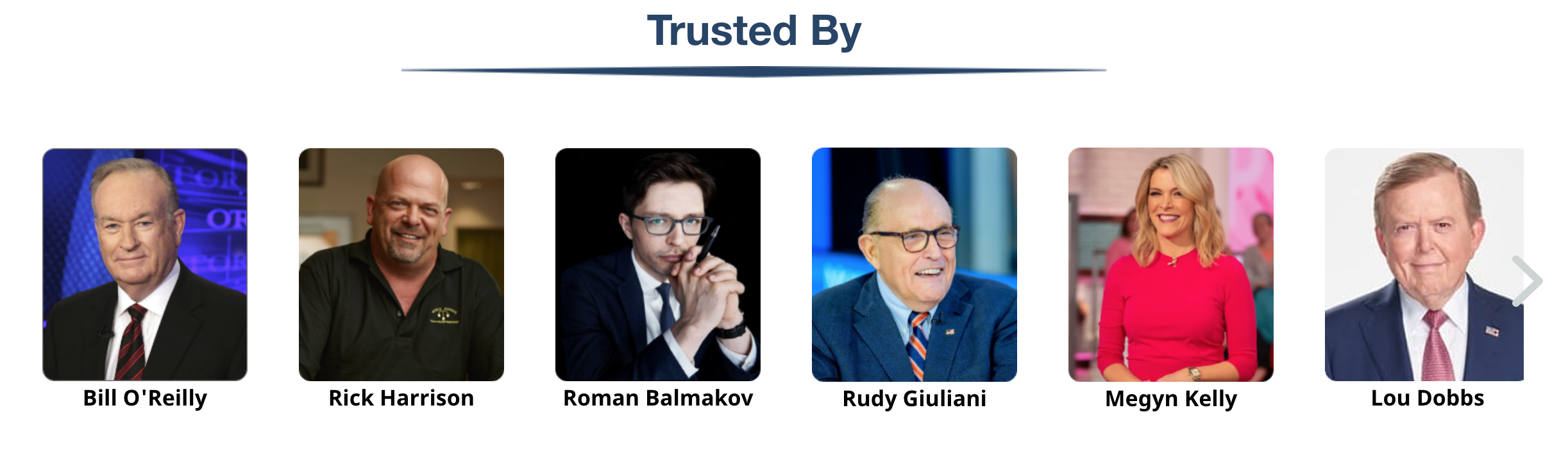

#4 Birch Gold Group

4.5/5 Rating

*Best delivery services

*Lowest minimum investment

*Great brand recognition

Birch Gold Group is a premier gold IRA company with a variety of benefits to investors. For starters, it has one of the lowest minimum investments and a competitive fee structure. It also offers insured shipping and discreet packaging. Most gold IRA companies charge a small fee to set up an account, but Birch Gold Group doesn't.

The company was established in 2003 in Burbank, California and supports over 13,000 customers. It offers gold and silver products as well as platinum and palladium investments, and its goal is to help investors diversify their portfolios. It also offers personalized customer support for IRA rollovers.

Birch Gold Group also offers a money-back guarantee and a buyer protection policy to first-time IRA investors. It offers no liquidation fees for gold withdrawals. Lastly, it offers a range of educational resources for investors, so you can choose the right investment for your goals.

Birch Gold Group charges a low annual fee. You can invest as little as $500 to $10,000. The minimum investment is not high compared to other companies, but you will want to invest at least that amount. Some of the best gold IRA companies require a minimum investment of at least $50,000 to open an account.

Whether you are rolling over your 401k into gold or transferring funds from an existing retirement account to a gold IRA, the process can be easy and simple. Companies that offer online applications are also more efficient than those that rely on paper and ink.

#5 Noble Gold

4.4/5 Rating

*Has cryptocurrency options

*Low minimum investment

*Great customer service

As an investment company, Noble is one of the top choices for gold IRA accounts. The company's services include quick and secure processing and segregated storage of your precious metals. You can also use their services for IRA rollovers. The company's IRA experts can help you avoid costly mistakes.

As one of the premier gold IRA companies in the US, Noble has expanded into international markets. In addition to gold, they offer a number of cryptocurrencies, including bitcoin. Their industry reputation is overwhelmingly positive, with a 99.9% client satisfaction rating. If you're interested in investing in gold, the company's website includes a FREE Physical Gold and Crypto IRA Investment Kit. In addition, they offer a free subscription to Forbes magazine.

Another benefit of working with Noble Gold is that they offer high-quality customer service. Many third-party review sites rate their services favorably. Their experience as a US precious metals dealer has given them an excellent reputation for customer service. Their dedicated Retirement Department has specialists who know the process and procedures of physical precious metals IRAs.

Noble Gold offers five different investment packages. The Knighthood Package includes investments in gold and silver that are enough to cover the average family's expenses for three months. The Kingship, Dynasty, and Coronation Portfolios combine precious metals and cryptocurrencies. This is the recommended choice for new investors.

Gold IRA Rollovers: Understanding the Process

A Gold IRA (Individual Retirement Account) is a way for individuals to invest in physical gold and other precious metals as a retirement savings vehicle. One popular way to invest in a Gold IRA is through a rollover. In this article, we will explore the process of doing a Gold IRA rollover and answer some frequently asked questions about this type of investment.

What is a Gold IRA Rollover?

A Gold IRA rollover is the process of transferring assets from an existing traditional IRA or 401(k) into a new Gold IRA. This is done through a direct rollover or trustee-to-trustee transfer, which allows for a seamless transfer of assets without incurring taxes or penalties. A Gold IRA rollover allows individuals to invest in physical gold and other precious metals as a retirement savings vehicle.

Can I do a Gold IRA Rollover?

Any individual under the age of 70.5 with an IRA or 401(k) is eligible to do a Gold IRA rollover. However, it's important to note that there are limits on the amount that can be contributed to a traditional IRA or Roth IRA each year. These limits are set by the IRS and are subject to change.

How do I do a Gold IRA Rollover?

The process of doing a Gold IRA rollover is relatively simple. The first step is to open a new Gold IRA account with a reputable custodian or trustee. Once the account is open, you will need to instruct your current IRA or 401(k) custodian to transfer the assets directly to the new Gold IRA account. It is important to ensure that the transfer is done through a direct rollover or trustee-to-trustee transfer to avoid taxes or penalties.

What are the benefits of a Gold IRA Rollover?

There are several benefits of doing a Gold IRA rollover. One of the key benefits is diversification. Gold has traditionally been a safe haven asset, meaning that its value tends to increase when stock and bond markets are in turmoil. By adding gold to your retirement portfolio, you can potentially reduce the overall risk of your investments. Additionally, a Gold IRA rollover allows you to invest in physical gold and other precious metals, providing protection against inflation.

Gold IRA FAQ

Q: Can I hold other types of precious metals in my Gold IRA?

A: Yes, you can hold other types of precious metals in a Gold IRA, such as silver, platinum, and palladium. However, it's important to note that there are specific rules and regulations that must be followed. The IRS has strict guidelines on the types of coins and bars that are allowed in a Gold IRA, and there are specific weight and purity requirements that must be met.

Q: Are there any age limits for investing in a Gold IRA?

A: There are no age limits for contributing to a Gold IRA. Any individual under the age of 70.5 with an IRA or 401(k) is eligible to do a Gold IRA rollover. However, there are restrictions on the age at which individuals can start taking distributions from a Gold IRA. The age at which individuals can start taking distributions from a Gold IRA is 59.5.

Q: Are there any contribution limits for a Gold IRA?

A: There are limits on the amount that can be contributed to a Gold IRA each year. These limits are set by the IRS and are subject to change. For the tax year 2021, the contribution limit for traditional and Roth IRAs is $6,000.

The Benefits of Gold IRA Investing

Investing in gold is a good idea if you are looking to hedge your savings against the economic forces that threaten your financial future. The benefits of investing in gold in an IRA are numerous and are well worth considering.

Diversification

Investing in precious metals offers many benefits, especially when it comes to your retirement portfolio. While you may not be able to prevent big losses or huge gains, you can enjoy the peace of mind of a diversified portfolio.

Diversification enables you to spread your money across different industries, geographic regions, and other markets. This helps you to lessen the risk of losing your entire savings in a single crash. In addition, it will smooth out your returns over time.

You can make a diversified portfolio by purchasing stocks, bonds, and other types of assets. However, it is important to be careful when selecting your investments. The market value of one asset can change quickly, due to changes in interest rates, investor preferences, and other factors.

Purchasing gold is another good option for diversification. Gold prices fluctuate on a daily basis, and are influenced by geopolitical events. When investing in gold, keep track of your investments, monitor price fluctuations, and stay up-to-date on any news that might affect your investments.

To start investing in precious metals, you must open an account with an investment platform. After creating an account, you will be asked to input your name, birthday, and password. Once you've entered all your information, you can set up alerts and manage your portfolio.

Investing in precious metals is a long-term investment, so don't expect a quick return. You can use a portfolio tracker or a spreadsheet to keep track of your investments. But don't forget to rebalance your portfolio periodically to help you weather inflation and price fluctuations.

Investing in a gold IRA gives you the flexibility to add to your retirement portfolio without taking on additional risk. It's a tangible way to gain financial diversification, and provides you with more control over your finances than a traditional IRA.

Inflation resistance

There are many benefits to investing in gold. This type of investment offers the ability to hedge against inflation. Inflation can make saving money difficult, and can cause your savings to lose value. Keeping your savings safe from inflation requires diversifying your portfolio.

When looking for an investment to protect your savings, you want to consider the risk and reward associated with each asset. An effective inflation hedge requires investments that appreciate at a ratio of at least one to one.

Gold and silver are two of the most stable assets on the market. These metals are also popular as safe havens during times of financial turmoil.

Gold IRAs can be a good way to diversify your investment portfolio. Although you should not invest everything you have in a single asset, you should consider putting a small percentage of your funds into gold.

One of the biggest advantages of investing in gold is that you can purchase physical gold. The company that operates the IRA will store your purchases in a secure depository. They will also provide you with education on precious metals investments.

Another benefit of investing in a gold IRA is the tax benefits. Most traditional IRAs and self-directed IRAs allow you to contribute before taxes. You can avoid paying taxes on your savings until you withdraw them later in life.

Gold IRAs are a great way to diversify your savings, and protect them from the risks of inflation. However, they also come with their own set of pros and cons. It is important to do your research and vet the companies you work with before you make a decision.

Some companies may use scare tactics to push you into purchasing gold. If you are not sure what to look for, you should talk to a financial planner.

Hedge your savings against economic forces

Gold IRAs offer a way to diversify your retirement savings and hedge against economic uncertainty. While there are many advantages, there are also some disadvantages. Before you invest, make sure you do your research. You can learn about the different types of gold IRAs and the best places to invest.

One of the main reasons people choose gold is that it is an effective hedging measure against inflation. There are two main forms of inflation: cost-push and demand-pull. Cost-push occurs when the price of raw materials increases. This causes inflation. It also reduces the purchasing power of money.

Demand-pull is a bit trickier. In this case, you have to worry about how much inflation you might see and how quickly. A good rule of thumb is to invest about 5 percent to 10 percent of your savings in precious metals.

Using gold in your retirement account offers a tax-efficient shelter from gains. It may not provide a rapid return, but it can help protect against the volatility of the markets.

As a practical matter, you can use exchange-traded funds to invest in precious metals, as well as alternative assets. For instance, you can buy precious metals, such as platinum and palladium, with an ETF.

Another advantage of investing in gold is that you'll be able to sell it for more money when prices rise. The value of your gold IRA will depend on how much scarcity there is in the market. If you plan on selling, you'll need to contact your depository. Some fees and penalties could apply, depending on your age.

However, the best thing about investing in gold is that it is a tangible way to diversify your financial portfolio. If you're concerned about the economy, a precious metal IRA is a great way to get started.

IRA-to-IRA rollover or direct transfer

If you want to diversify your savings portfolio, a gold IRA rollover or direct transfer is a great option. Gold is not affected by the strength of the dollar. However, the value of your portfolio will decrease over time if the value of the dollar drops. As a result, it is vital to have a portion of your retirement portfolio in precious metals.

Whether you are considering a rollover or a direct transfer, there are certain guidelines you need to follow. Failure to adhere to these guidelines can result in penalties and taxation of the transferred funds.

The IRS requires all IRA rollovers to be reported. They will look at the paper trail to determine the taxes due on the rollover. All rollovers must be made within a 12-month period starting from the day the IRA was distributed.

If you do not meet this deadline, you may have to pay a 10% penalty on the amount you withdrawn. It is always best to discuss any changes in your IRA with an expert.

There are three different types of IRAs. These are the Traditional IRA, Roth IRA, and SIMPLE IRA. While some custodians do offer a direct rollover, it is not guaranteed. For example, not all custodians will send 1099-R forms to individuals who have rolled over their IRAs.

Another type of IRA is a SEP IRA. This type of IRA is intended for small business owners. Unlike a traditional IRA, a SEP IRA is funded with pre-tax dollars. You can only roll over a portion of your funds into this IRA.

You can also transfer funds from a 401k, Solo 401k, or other employer-sponsored plan. A direct rollover involves moving your money directly from your previous IRA trustee to a new one.

IRA depositories don't work for free

A gold IRA or two is the epitome of cool and classy. A top of the line high-tech facility can be the envy of your more pampered colleagues. With the proper swagger, it is easy to get out of the gate and savor a night on the town. The tinsel town crowd consists of the usual suspects and a few curious uninitiated souls. There is no denying the fact that there are a few shady types around. Keeping your wits about you is a surefire way to stay on top of your game. After all, what's the fun in being a dummy?

When is the Best Time to Invest in Gold?

There are a few factors that must be considered when deciding when to invest in gold. These include whether you want to buy Physical or Gold futures, and whether you plan to store the money in your bank account or in an IRA.

Physical gold

The best time to invest in physical gold is a matter of personal choice. Traditionally, many people turn to gold during times of economic uncertainty. In recent years, the price of gold has been increasing steadily.

However, it is important to note that investing in gold does not necessarily guarantee a high return. Although it is a great diversification tool, it is also a volatile investment. There are times when gold has outperformed other investments.

The best time to invest in gold is when it is inexpensive. It is important to keep in mind that a cheap asset has substantial upside potential.

Investing in gold is a great way to protect your wealth. If you have recently acquired wealth, it is sensible to hedge against bad decisions. This can be done by diversifying your portfolio.

Gold has shown strong average returns over the past few decades. You can invest in the physical metal, or invest in a Gold IRA. Both are a tax efficient way to manage your retirement fund.

Physical gold is also safer than other forms. Besides, it retains its value over time. Purchasing coins from banks can be expensive, but you will receive a certificate of authenticity for your purchase.

As an investor, it is important to research the market. There are many online resources to help you get started. Some of these portals offer an informative list of commodities to watch out for.

Gold stocks

Adding gold to your portfolio can diversify your assets. It can also be a way to help your portfolio weather a recession. Whether you decide to buy physical gold or invest in an exchange-traded fund (ETF), it can be a rewarding investment.

While gold isn't as smart an investment as stocks or bonds, it can still be a worthwhile addition to your investment portfolio. Depending on your goals and risk tolerance, you may want to buy gold in different ways.

Buying gold in the form of a physical asset, like coins, can be more complicated. You will have to weigh the costs of storage and insurance. If you choose an ETF, you may have to factor in the costs of margin requirements.

Gold stocks, on the other hand, are a much simpler and easier investment to make. Many companies focus on mining gold or distributing it to investors. These companies often demonstrate strong dividend performances, which can help boost the price of gold.

The best time to buy gold is when it's cheap. For example, you can purchase gold at the start of a new year, during the holiday season, or whenever rates are expected to rise alongside inflation.

However, you shouldn't be confused by the term "cheapest." There are many things to consider when buying gold. Some investors prefer to buy gold during periods of stable markets. Others like to buy it when they believe inflation is on the rise.

Gold futures

If you're considering investing in gold, there are a few things you'll need to consider. Among these are the risks involved, your initial investment, and how much time you have to dedicate to research and prep.

Buying gold in the futures market involves high risk. The amount of money lost can exceed the original investment. Additionally, gold prices can fluctuate dramatically before the settlement date. For this reason, you will want to keep a close eye on your investments.

One of the best ways to invest in gold is through exchange-traded funds. ETFs track the price of metals, such as gold, silver, and platinum. They are also a great way to gain exposure to the market.

Another option is to buy physical gold. However, this can be a complicated process. You may need to set up a brokerage account and get the appropriate collateral in order to receive the product. Some dealers will only deliver to you if you pay a premium to cover their costs.

Alternatively, you can invest in options on gold futures. These give you the option to purchase a futures contract, which gives you the right to buy or sell gold at a specified date.

Gold futures have become extremely popular as an investment strategy. Traders can buy and sell large quantities for a relatively small amount of money. In addition, this is a great way to speculate on the price of gold.

Diversification benefits

Gold is one of the best options for diversifying portfolios. It has high returns over time and acts as a hedge against inflation. However, its performance can vary based on several factors. So, before investing, be sure to understand how to invest in gold.

When the economy starts to slow down, the stock market tends to fall, and gold prices often go up. This can help protect your money from a decline in the stock market. Also, you can sell gold when the price goes down.

There are several types of funds that offer exposure to gold. Some offer only physical gold while others focus on mining companies. Depending on your risk tolerance and financial goals, you may want to allocate a different portion of your portfolio to gold.

Gold can be a good option for investors who are skeptical about the future of the economy. Historically, gold has been low-correlated with most other asset classes. If you believe that the economy is going to go down, you might want to allocate at least half of your investment to gold-related securities.

Another advantage of owning gold is the fact that it does not experience much volatility. Although the price of gold is largely determined by global markets, investors should be aware of other factors that can affect its performance. For example, investors should be prepared to pay taxes on gains from their investments.

Worst mistakes people make

When it comes to investing in gold, there are many pitfalls to avoid. Gold can be a useful investment, but it is also susceptible to market fluctuations. The price can drop significantly after you purchase it. It may be hard to sell it for full market value, too.

There are many reasons people invest in gold. Some investors want to diversify their portfolios, while others seek a safe haven during times of turmoil.

The benefits of owning gold include protection from inflation and a possible return on your investment. This type of investment can be beneficial, but it requires a little research and due diligence. If you are new to the game, you may have more questions than answers.

The best way to invest in gold is to buy physical gold. You can store the metal yourself or have it stored by a third party. But before you do that, you should know how to choose the right kind of gold for your needs.

A good investment strategy will incorporate several key elements. One of the most important aspects is knowing your goal. Your goals will help you decide what kind of gold to invest in.

Another key aspect is determining your budget. Depending on how much you have to spend, you might have to limit your gold purchases to make room for other asset opportunities.

As you make your investment decisions, remember to stay in the game for the long haul. While the price of gold may rise or fall over time, you should always keep an eye out for a financial crisis.

Storing gold

If you are interested in investing in gold, there are many ways you can go about it. One of the most common ways is to purchase gold in the form of coins or bars. This can be a physically satisfying way to invest in the precious metal. However, it comes with its own set of risks. You may need to get insured if you want to own gold.

Other forms of gold investments include exchange traded funds (ETFs) and gold-related stocks. Investing in these products offers the advantage of diversification and tax efficiency. But they come with some systematic risks as well.

The best time to buy and hold gold is based on your specific investment objectives. Whether you are looking for a hedge against inflation, or you're just a gold lover, knowing when to purchase is important.

Some of the most common times to buy gold are when you're accumulating, when you're winding down your career, or when you've been given an inheritance. If you're unsure, an online financial advisor can help you find the right timing.

Another common time to invest in gold is when you're worried about the stock market. Buying and holding gold is a great way to diversify your portfolio. It can also act as a hedge against an economic emergency.

Gold is a great way to protect your wealth. Many of the world's most successful investors use this strategy. They believe it can protect newly acquired assets from bad decisions or market crashes.